auditor independence tax services

The Center has compiled the following resources to assist employee benefit plan auditors in. Notably absent from the list are tax services.

New Audit Independence Rules Are You Impacted Smith Williamson

5 require that all other audit and non-audit services 6 including tax services be approved by the companys 7 audit committee.

. The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB ethics and independence rules concerning independence tax services and contingent fees. These services will largely be those required by law and regulation loan covenant reporting other assurance services closely. Service provided by the audit firm may impair the firms independence in fact or appearance.

Recent changes to the independence standards may change the way tax professionals and approved self-managed super fund SMSF auditors represent their clients. If you know that the auditor for ABC Company keeps a. Washington DC Apr.

The SEC likewise requires independence by the external auditors who perform an audit of managements assertions in the registrants. Tue 26 May 2020 1200 GMT. Moving to a whitelist of permitted nonaudit services for UK incorporated EU PIEs EU PIEs.

The Financial Reporting Council FRC has recently made significant revisions to its UK Ethical Standard. Pre-approval of Permitted Services Subject to certain limited exceptions the audit committee must pre-approve all permitted services provided by the independent auditor ie tax services comfort letters statutory audits or other. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in switching tax consultants plus the resultant increased tax costs they sustain amount to deadweight losses financial sacrifice with no compensating gain in accounting.

This may affect your practices and businesses. Audit practitioners could be more comfortable in providing audit-related non-audit or tax services for audit clients since these services could facilitate audit. The Revised Ethical Standard 2019 will take effect on 15 March 2020.

Not to be independent and the cost. Since 2010 revenue from the Big Four accounting firms consulting businesses have more than doubled globally up a combined 136. The SEC includes tax among the non-audit services CPA firms provide.

Auditor Independence and Tax Practitioners. These new concerns relate to the tax 11 services and products that audit firms provide to their. Services other than the year-end audit and tax return functions for the approved private school for students with disabilities.

The SECs Division of Corporate Finance Office of the Chief Accountant has also expressed the view that assisting an issuer client or providing software that would do so in the preparation of its income tax accrual as opposed to proposing adjustments as a result of auditing managements accrual would impair an auditors independence Application of the. The AICPA Code of Professional Conduct requires that members in public practice be objective free of conflicts of interest and independent in fact and appearance section 300050. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping financial information systems design and implementation appraisal and valuation services actuarial services and internal audit services.

Auditors are expected to provide an unbiased and professional opinion on the work that they audit. In comparison revenue related to tax and legal services grew just 59 while audit fees grew just 19 said Mark OConnor CEO and co-founder of Monadnock Research LLC which tracks the consulting industry. Independence standards for tax professionals with SMSF clients.

By removing the tax-strategies language and reiterating the policy that CPAs can provide tax services such as compliance planning and advice to audit clients without impairing independence the SEC has likely narrowed the circumstances where impairment can happen. Recent changes to audit independence rules will impact businesses of all sizes as the FRC increases the separation of audit and non-audit services and introduces further restrictions. Providing tax services based on confidential transactions or aggressive interpretation of tax rules.

The final rules adopted on October 16 2020 principally focus on complications that. The Commission rules include certain. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it.

Our relentless focus on quality drives accurate results and transforms the audit process. EXECUTIVE SUMMARY THE SECs NEW AUDITOR INDEPENDENCE RULES could have a significant effect on some tax practitioners. This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a sample of bankruptcy filing firms.

The AICPA DOL and SEC all have rules regarding auditor independence. Key changes regarding auditor independence include. Please be advised if the yearend auditor performs any additional financial service for the private school - other than the preparation of tax returns the auditor will be considered.

The DOL rules apply to all employee benefit plan auditors the AICPA rules also apply to those auditors who are members of the AICPA and the SECs rules apply to auditors of plans that file on Form 11-K with the SEC. What is Auditor Independence. Providing tax services to management members or their immediate family who have a role in financial reporting.

A new and updated Independence Guide Fifth Edition May 2020 the Guide was. The evidence from the bankruptcy setting is particularly salient given that the bankruptcy of corporations such as Enron motivated several provisions of the. Ad Our integrated technology solutions simplify your audit and deliver enhanced quality.

The rules introduce a foundation for the independence component of the Boards ethics rules by. The Securities and Exchange Commission SEC has issued final rules that significantly modify the framework that public companies and their auditors use to evaluate auditor independence providing additional clarity for certain particularly difficult and recurring issues. AS PROPOSED THE SEC RULES PUT IN DOUBT whether an auditor can do anything other than review the tax provision in the.

In addition the new rules define the approval process an audit firm must pursue with a clients audit committee when proposing. 8 Since the Commission adopted these rules new 9 concerns relating to auditor independence have come to 10 public attention. Of particular relevance to tax professionals whereas the SEC Rules largely exempted tax services from the list of non-audit services deemed to impair an Auditors independence Sarbanes-Oxley provides no such blanket exemption for tax services and indeed permits an Auditor to perform non-audit tax services on behalf of an Issuer only if the tax.

An auditor who lacks independence virtually renders their accompanying auditor report useless to those who rely on them. For example consider yourself a potential investor in ABC Company.

Et Section 101 Independence Pcaob

Audit Fees Of The S P 500 Audit Fees Of The S P 500 Audit Analyticsaudit Analytics

The Importance Of Independence Of Your Auditor Exceed

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

The Effects Of Non Audit Services On Auditor Independence An Experimental Investigation Of Supervisory Board Members Perceptions Sciencedirect

Employment Office Of The State Auditor

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

Should Your Auditor Prepare Your Tax Return Cfo

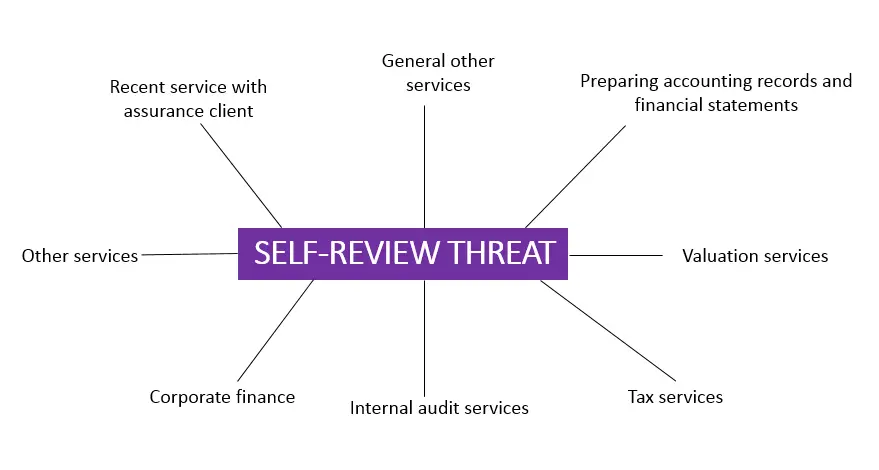

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Who Make The Best Audit Committee Members

Building On Our Audit Quality Foundations Kpmg Global

Et Section 101 Independence Pcaob

Maintaining Auditor Independence When Giving Accounting Assistance And Advice The Cpa Journal